Dental Insurance Plans Humana: Comprehensive Coverage for Your Smile

Discover the world of dental insurance plans humana, where we provide a comprehensive overview of Humana's dental insurance offerings. From coverage details to plan comparisons, we'll guide you through the intricacies of dental insurance, empowering you to make informed decisions for your oral health.

Humana's dental insurance plans are meticulously designed to meet the diverse needs of individuals and families. With a wide range of options, you're sure to find a plan that aligns with your specific requirements and budget.

Dental Insurance Plans Humana

Humana offers a range of dental insurance plans to meet the diverse needs of individuals and families. These plans provide coverage for a wide range of dental services, including preventive care, basic restorative procedures, and major dental work.

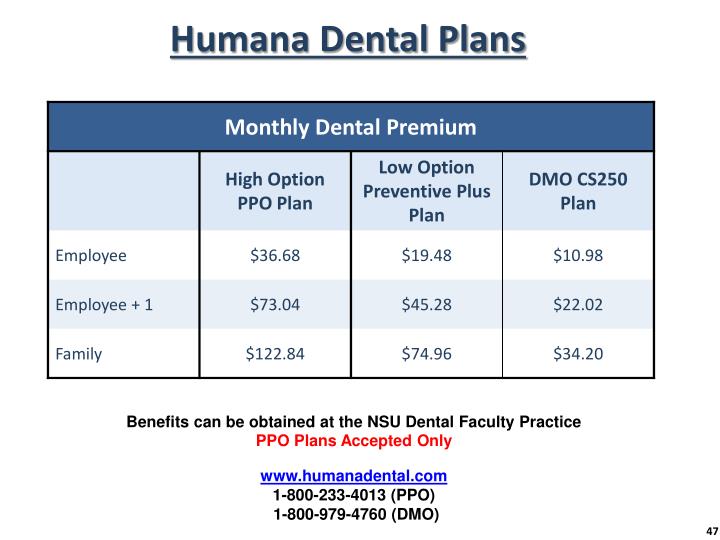

To help you make an informed decision about which plan is right for you, here is a comparison table that summarizes the key features of Humana's dental insurance plans:

| Plan | Coverage | Premium | Deductible |

|---|---|---|---|

| Humana Dental PPO | Preventive care, basic restorative procedures, major dental work | Varies depending on location and coverage level | $50 per person, per year |

| Humana Dental HMO | Preventive care, basic restorative procedures | Varies depending on location and coverage level | $0 per person, per year |

| Humana Dental Indemnity | Reimbursement for covered dental services | Varies depending on location and coverage level | $0 per person, per year |

Benefits of Humana Dental Insurance Plans

- Access to a network of experienced dentists

- Coverage for a wide range of dental services

- Preventive care benefits to help keep your teeth and gums healthy

- Discounts on dental services

- Convenient online tools to manage your account and find a dentist

Drawbacks of Humana Dental Insurance Plans, Dental insurance plans humana

- Higher premiums than some other dental insurance plans

- Limited coverage for major dental work

- Network restrictions may limit your choice of dentists

- Waiting periods for certain services

Coverage and Exclusions: Dental Insurance Plans Humana

Humana's dental insurance plans provide coverage for a wide range of dental procedures, including preventive care, basic restorative treatments, and major dental work. However, it's important to understand the exclusions and limitations of the plans to ensure that you are fully aware of what is and is not covered.

Preventive Care

Humana's dental insurance plans typically cover preventive care services such as regular checkups, cleanings, and fluoride treatments. These services are essential for maintaining good oral health and preventing the development of more serious dental problems.

Basic Restorative Treatments

Humana's dental insurance plans also cover basic restorative treatments such as fillings, crowns, and bridges. These treatments are used to repair damaged teeth and restore their function. However, there may be limitations on the number of these treatments that are covered per year.

Major Dental Work

Humana's dental insurance plans may also cover major dental work such as root canals, extractions, and dentures. However, these treatments are typically subject to higher deductibles and co-pays.

Exclusions

There are some dental procedures that are not covered by Humana's dental insurance plans. These exclusions typically include cosmetic procedures, such as teeth whitening, and procedures that are considered experimental or investigational.

Premiums and Deductibles

Humana's dental insurance premiums are determined based on several factors, including the type of plan selected, the level of coverage desired, and the geographic location of the policyholder. Premiums can vary widely depending on these factors.

Deductibles are the amount of money that the policyholder must pay out-of-pocket before the insurance coverage begins. Out-of-pocket expenses also include copayments and coinsurance, which are fixed amounts or percentages of the cost of covered services that the policyholder must pay.

Factors Affecting Deductibles and Out-of-Pocket Expenses

- Type of plan:PPO plans typically have lower deductibles and out-of-pocket expenses than HMO plans.

- Level of coverage:Plans with higher levels of coverage, such as those that include orthodontic or cosmetic services, typically have higher deductibles and out-of-pocket expenses.

- Geographic location:The cost of dental care varies depending on the geographic location. Premiums and deductibles are typically higher in urban areas than in rural areas.

Breakdown of Costs Associated with Each Plan

The specific costs associated with each Humana dental insurance plan will vary depending on the factors discussed above. However, the following is a general breakdown of the costs that policyholders can expect to pay:

- Monthly premiums:The monthly premium is the amount that the policyholder pays to Humana each month for coverage.

- Deductible:The deductible is the amount of money that the policyholder must pay out-of-pocket before the insurance coverage begins.

- Copayments:Copayments are fixed amounts that the policyholder must pay for covered services, such as office visits or X-rays.

- Coinsurance:Coinsurance is a percentage of the cost of covered services that the policyholder must pay, such as 20% or 30%.

- Out-of-pocket maximum:The out-of-pocket maximum is the total amount of money that the policyholder must pay out-of-pocket for covered services in a given year.

Network of Providers

Humana's dental insurance plans provide access to a vast network of dental providers, ensuring you have convenient and affordable options for your dental care needs. The network includes a wide range of dentists, specialists, and dental facilities, allowing you to choose the right provider for your specific requirements.

Finding and Choosing a Dentist

To find a dentist within Humana's network, you can use the online provider directory on Humana's website. The directory allows you to search for dentists based on location, specialty, and availability. You can also call Humana's customer service line for assistance in finding a dentist.

Benefits of Using In-Network Providers

Using in-network providers offers several benefits:

- Lower Costs:In-network providers have negotiated rates with Humana, which can result in lower out-of-pocket costs for you.

- Convenience:In-network providers are located throughout the country, making it easier to find a dentist near you.

- Quality Assurance:Humana's network providers have met certain quality standards and are committed to providing high-quality dental care.

By choosing an in-network provider, you can maximize the benefits of your Humana dental insurance plan and enjoy affordable, convenient, and high-quality dental care.

Claims and Reimbursements

Humana's dental insurance plans offer a streamlined process for filing claims and receiving reimbursements. The following information provides a detailed overview of the claims process and the options available for reimbursement.

Filing Dental Claims

To file a dental claim with Humana, you can use one of the following methods:

- Online:Submit claims through Humana's secure online portal.

- Mail:Send completed claim forms to Humana's designated mailing address.

- Fax:Fax claim forms to Humana's designated fax number.

Methods of Reimbursement

Humana offers two methods of reimbursement for dental claims:

- Direct Reimbursement:Humana will send the reimbursement directly to the dental provider.

- Assignment of Benefits:You can assign your benefits to the dental provider, allowing them to bill Humana directly.

Timeframes for Processing Claims

Humana aims to process dental claims within the following timeframes:

- Electronic Claims:5-7 business days

- Paper Claims:10-12 business days

The processing time may vary depending on the complexity of the claim and the availability of necessary information.

Customer Service and Support

Humana provides a range of customer service options to assist its dental insurance members. Members can access support through various channels, ensuring prompt and convenient assistance.

Contacting Customer Support

Humana offers multiple methods for members to contact customer support:

- Phone:Members can call the dedicated customer service number to speak with a representative directly.

- Online Chat:Humana's website features a live chat option for members to connect with a customer service agent in real-time.

- Email:Members can send their inquiries or requests via email to Humana's customer support team.

- Mail:Written correspondence can be mailed to Humana's customer service address.

Online Resources and Self-Service Tools

In addition to direct customer support, Humana provides a comprehensive suite of online resources and self-service tools:

- Member Portal:Members can access their account information, view claims, and manage their dental benefits through Humana's secure member portal.

- Frequently Asked Questions (FAQs):Humana's website hosts a comprehensive FAQ section that provides answers to common questions about dental coverage.

- Dental Health Library:Members can access valuable information and resources on dental health, oral hygiene, and treatment options.

Humana's customer service team is committed to providing prompt and professional assistance to its dental insurance members. Members can expect courteous and knowledgeable support through the various channels available.

Conclusion

As you navigate the landscape of dental insurance, Humana stands as a trusted partner, committed to providing exceptional coverage and unparalleled support. Their customer-centric approach ensures that your dental needs are met with the utmost care and efficiency. Embrace the power of Humana's dental insurance plans and safeguard your smile for years to come.