Get the Best Home and Auto Insurance Quotes from USAA

USAA home and auto insurance quotes are essential for protecting your assets and ensuring peace of mind. With USAA, you can get tailored coverage options that meet your specific needs and budget. This comprehensive guide will provide you with all the information you need to obtain a USAA home and auto insurance quote and make an informed decision.

Understanding the different coverage options available under USAA home and auto insurance policies is crucial when obtaining a quote. It helps you determine the right level of protection for your home, vehicles, and belongings.

Introduction

USAA is a leading provider of insurance products, including home and auto insurance, for military members, veterans, and their families. USAA home and auto insurance policies offer a range of coverage options to protect your home, car, and belongings. Obtaining a quote for USAA home and auto insurance is a simple and straightforward process that can help you determine the right coverage and cost for your needs.

By obtaining a quote, you can compare coverage options and premiums from USAA with other insurance providers. This allows you to make an informed decision about the best insurance coverage for your specific situation.

Obtaining a Quote

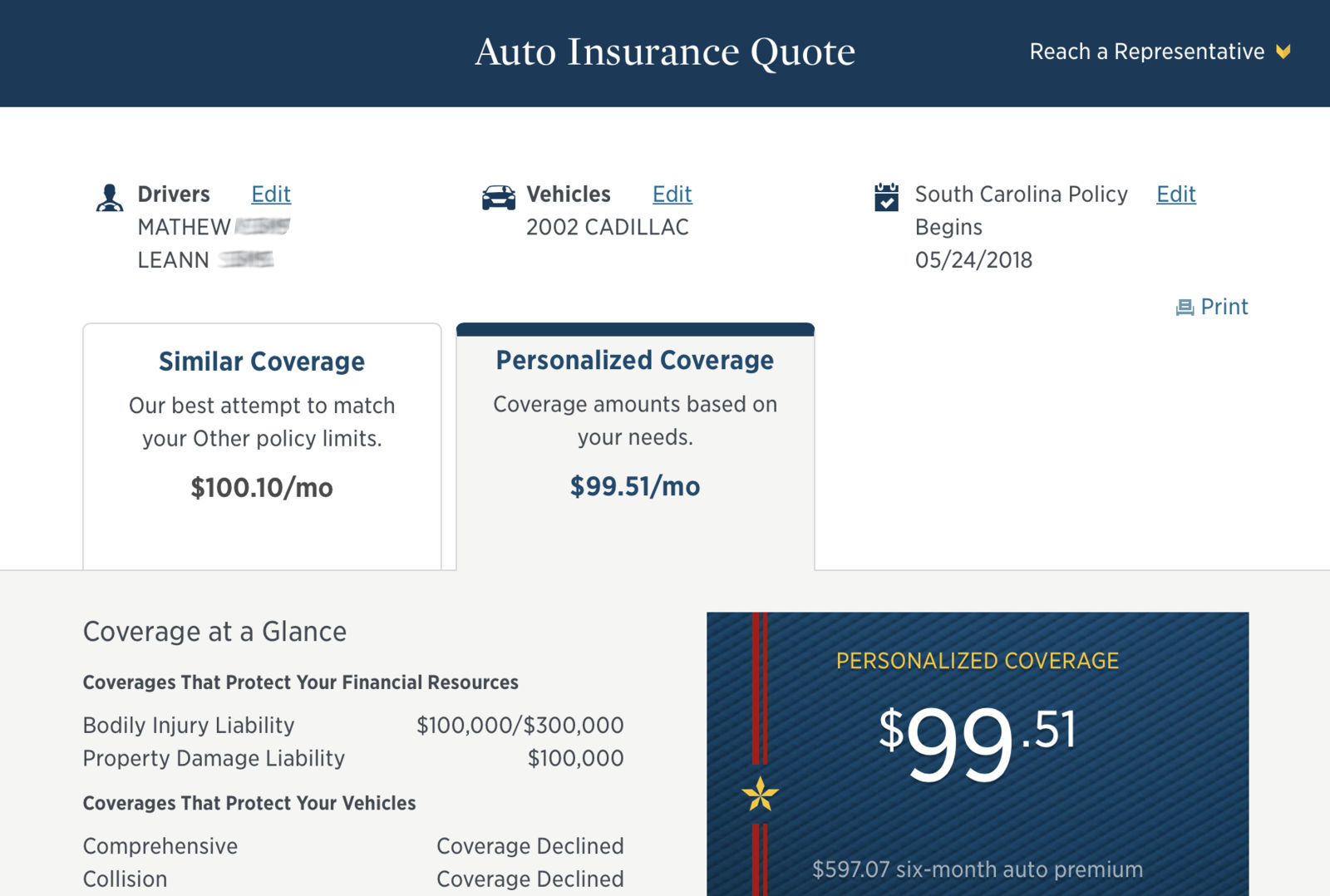

To obtain a quote for USAA home and auto insurance, you can visit the USAA website or contact a USAA insurance agent. You will need to provide information about your home, car, and driving history. USAA will use this information to calculate a quote for your insurance coverage.

Once you have obtained a quote, you can review the coverage options and premiums to determine if USAA is the right insurance provider for you. You can also compare quotes from other insurance providers to ensure you are getting the best coverage and price for your needs.

Coverage Options

USAA offers a comprehensive range of coverage options for home and auto insurance policies. Understanding these options is crucial when obtaining a quote to ensure that your policy aligns with your specific needs and provides adequate protection.

Home insurance policies typically include coverage for the dwelling itself, as well as personal belongings, additional structures on the property, and liability protection. Auto insurance policies, on the other hand, provide coverage for the vehicle, its occupants, and liability arising from accidents.

Coverage Options for Home Insurance

- Dwelling coverage:Protects the physical structure of your home, including walls, roof, and foundation.

- Personal property coverage:Covers your belongings, such as furniture, electronics, and clothing, in case of damage or loss.

- Additional structures coverage:Provides protection for detached structures on your property, such as garages, sheds, or guest houses.

- Liability coverage:Protects you financially if someone is injured or their property is damaged on your property.

Coverage Options for Auto Insurance

- Collision coverage:Covers damage to your vehicle caused by a collision with another vehicle or object.

- Comprehensive coverage:Provides protection against damage or loss due to events other than collisions, such as theft, vandalism, or natural disasters.

- Liability coverage:Protects you financially if you cause an accident that results in bodily injury or property damage to others.

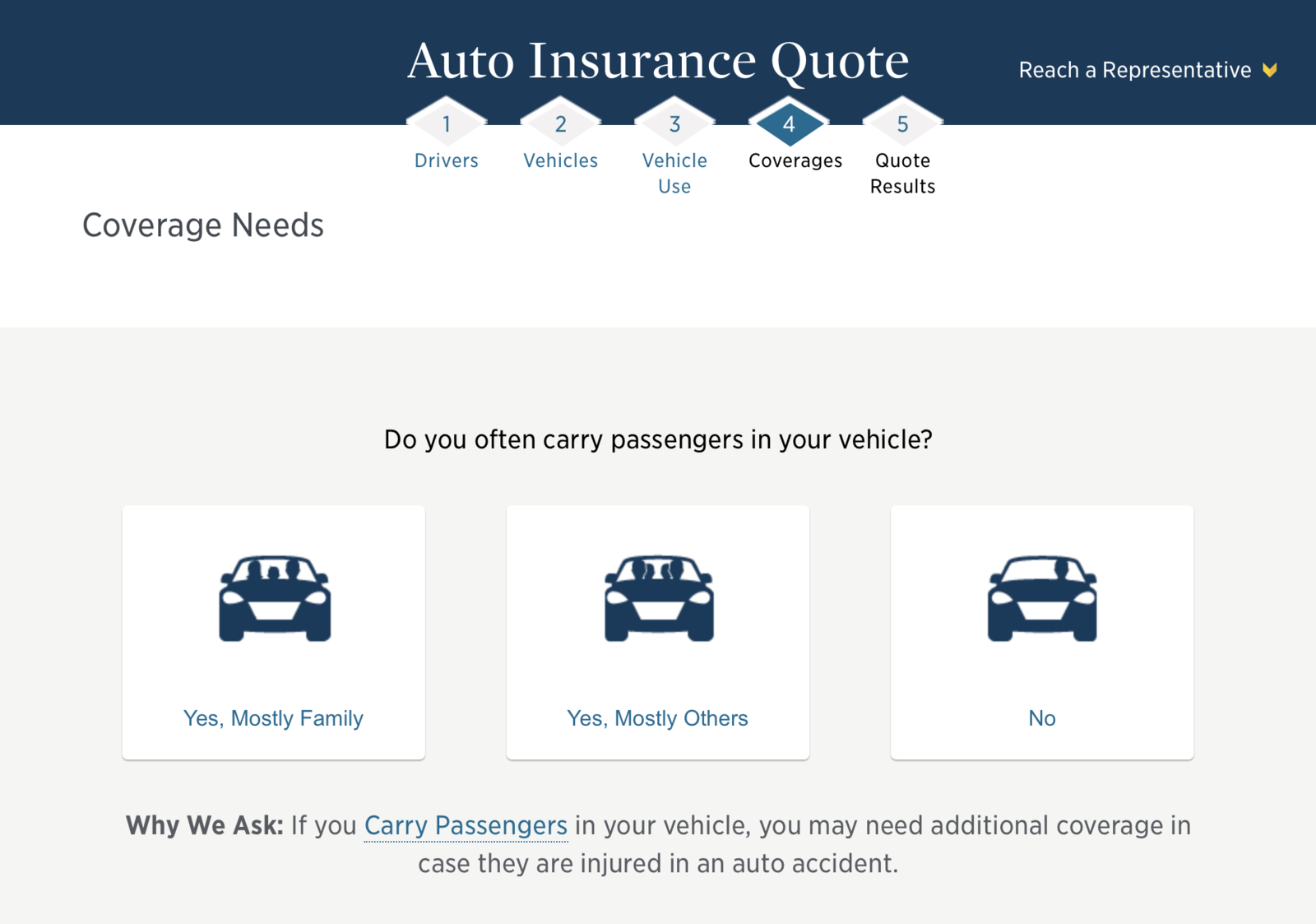

- Personal injury protection (PIP):Covers medical expenses and lost wages for you and your passengers in case of an accident, regardless of fault.

- Uninsured/underinsured motorist coverage:Provides protection if you are involved in an accident with a driver who does not have insurance or does not have sufficient coverage.

Factors Affecting Quotes

The cost of a USAA home and auto insurance quote can vary depending on several factors. These include:

Location:The location of your home and vehicles can affect your insurance rates. For example, homes and vehicles in areas with high crime rates or natural disasters may be more expensive to insure.

Age of the policyholder:Younger drivers and homeowners are typically charged higher insurance rates than older individuals. This is because they are considered to be a higher risk.

Driving history:Drivers with a history of accidents or traffic violations will typically pay higher insurance rates than those with clean driving records.

Credit score:In some states, insurance companies can use your credit score to determine your insurance rates. A lower credit score may result in higher insurance rates.

Obtaining a Quote

Obtaining a quote for USAA home and auto insurance is a straightforward process that can be completed in a few simple steps.

There are several methods available for obtaining a quote, including online, over the phone, or through an agent.

Online

The online quote process is quick and convenient, allowing you to receive a quote in just a few minutes. To get a quote online, visit the USAA website and select the "Get a Quote" option. You will then be asked to provide some basic information about yourself, your home, and your vehicles.

Over the Phone

If you prefer to speak to a representative directly, you can call USAA at 1-800-531-USAA (8722). A representative will be able to assist you with getting a quote and answer any questions you may have.

Through an Agent

If you would like to work with an agent, you can find a local agent through the USAA website. An agent can meet with you in person or over the phone to discuss your insurance needs and provide you with a quote.

Comparing Quotes

Obtaining quotes from multiple insurance providers is crucial for finding the most suitable and cost-effective coverage. Comparing quotes allows you to evaluate the coverage options, premiums, and deductibles offered by different insurers.

Tips for Comparing Quotes Effectively

- Gather accurate information:Provide consistent details to each insurer to ensure comparable quotes. This includes information about your vehicle, driving history, and coverage needs.

- Compare coverage options:Ensure that the quotes you compare provide similar levels of coverage. Check for deductibles, limits, and any additional coverages that may be included.

- Consider premiums and discounts:Premiums are the periodic payments you make for your insurance. Compare the premiums offered by different insurers and ask about any discounts that may apply, such as multi-policy or good driving history discounts.

- Review the financial stability of insurers:Choose insurers with strong financial ratings to ensure they have the ability to pay claims in the event of an accident.

- Read reviews and seek recommendations:Check online reviews and ask for recommendations from friends, family, or trusted sources to gather insights about different insurers and their customer service.

Making a Decision: Usaa Home And Auto Insurance Quote

Selecting the most suitable USAA home and auto insurance policy requires careful consideration of several key factors. It is essential to choose a policy that aligns with your specific needs and financial constraints.

When making a decision, consider the following:

Coverage

- Ensure the policy provides adequate coverage for your home, its contents, and your vehicles.

- Review the coverage limits and deductibles to determine if they meet your requirements.

- Consider any additional coverage options that may be beneficial, such as personal liability or flood insurance.

Budget

- Determine the premium you can afford to pay and compare it to the cost of the policy.

- Consider the long-term financial implications of the policy, including potential increases in premiums.

- Explore any discounts or savings that may be available to reduce the cost of the policy.

Customer Service, Usaa home and auto insurance quote

- Research the reputation of USAA for customer service and claims handling.

- Read online reviews or talk to current customers to gather feedback on their experiences.

- Consider the availability of online tools and resources that can make managing your policy convenient.

Personal Circumstances

- Consider your lifestyle, driving habits, and any special circumstances that may affect your insurance needs.

- Review the policy exclusions and limitations to ensure they do not conflict with your specific situation.

- Make sure the policy provides coverage for any valuable belongings or special items you may own.

Ending Remarks

Choosing the right USAA home and auto insurance policy is essential for protecting your assets and ensuring financial security. By following the steps Artikeld in this guide, comparing quotes, and considering your specific needs and budget, you can make an informed decision that provides you with peace of mind and the best possible coverage.