How Much is Auto Insurance in Massachusetts: A Comprehensive Guide

How much is auto insurance in massachusetts - Unveiling the intricacies of auto insurance in Massachusetts, this guide delves into the factors shaping premiums, average rates, provider comparisons, and strategies for saving. Get ready to navigate the insurance landscape with clarity and confidence.

Cost Factors Influencing Auto Insurance Premiums in Massachusetts

Determining the cost of auto insurance in Massachusetts involves considering a multitude of factors. These variables, ranging from personal characteristics to vehicle-specific details, play a crucial role in shaping the premiums drivers pay. Understanding these factors empowers individuals to make informed decisions and potentially lower their insurance costs.

The following list provides a comprehensive overview of the key factors that influence auto insurance premiums in Massachusetts:

Driving History

- Accidents and Violations:Drivers with a history of accidents or traffic violations face higher premiums, as they are considered higher risks by insurance companies.

- Years of Experience:Generally, drivers with more years of experience behind the wheel benefit from lower premiums, as they are statistically less likely to be involved in accidents.

Vehicle Type

- Make and Model:The make and model of a vehicle can impact premiums. Sports cars and luxury vehicles typically carry higher premiums than more common or economical models.

- Safety Features:Vehicles equipped with advanced safety features, such as anti-lock brakes and airbags, may qualify for discounts on insurance premiums.

- Vehicle Value:The value of a vehicle is a factor in determining premiums. More expensive vehicles generally cost more to insure.

Personal Characteristics

- Age:Younger drivers, particularly those under the age of 25, typically pay higher premiums due to their increased risk of accidents.

- Gender:In Massachusetts, male drivers generally pay higher premiums than female drivers, as statistics show they are more likely to be involved in accidents.

- Marital Status:Married drivers often benefit from lower premiums compared to single drivers.

Location

- ZIP Code:Insurance companies consider the ZIP code of a driver's residence when determining premiums. Areas with higher rates of accidents or theft tend to have higher premiums.

- Urban vs. Rural:Drivers in urban areas typically pay higher premiums than those in rural areas due to increased traffic congestion and higher rates of accidents.

Coverage Options

- Liability Coverage:This coverage is required by law in Massachusetts and provides financial protection if a driver causes an accident resulting in bodily injury or property damage to others.

- Collision Coverage:This coverage pays for repairs or replacement of a driver's own vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive Coverage:This coverage provides protection against non-collision events, such as theft, vandalism, and weather-related damage.

Average Insurance Rates and Premiums

Auto insurance rates in Massachusetts vary depending on several factors, including the driver's profile. On average, good drivers with a clean driving record pay lower premiums compared to young drivers, drivers with accidents or violations, and drivers with poor credit scores.

Good Drivers

Good drivers typically have a clean driving record with no accidents or violations within the past few years. They also maintain a good credit score, which is a key factor in determining insurance rates. On average, good drivers in Massachusetts pay around $1,200 per year for auto insurance.

Young Drivers

Young drivers, typically those under the age of 25, face higher insurance premiums due to their lack of driving experience and increased risk of accidents. On average, young drivers in Massachusetts pay around $2,000 per year for auto insurance.

Drivers with Accidents or Violations

Drivers with accidents or violations on their driving record will likely pay higher insurance premiums. The severity and type of the violation or accident will impact the increase in premium. On average, drivers with a single at-fault accident in Massachusetts can expect to pay an additional $400 to $600 per year for auto insurance.

Comparison of Insurance Providers

In Massachusetts, several insurance providers offer auto insurance policies with varying rates and coverage options. Comparing these providers is crucial to finding the most suitable and cost-effective coverage.

The following table provides a comparison of the insurance rates and coverage options offered by major insurance providers in Massachusetts:

Insurance Provider Comparison Table

| Company Name | Average Rates | Discounts | Policy Features |

|---|---|---|---|

| GEICO | $1,500 | - Multi-car |

- Good driver

- Safe driving

- Roadside assistance

- Accident forgiveness

- Multi-policy

- Defensive driving

- Usage-based insurance

- Rideshare coverage

- Safe driver

- Loyalty

- Accident management

- Vehicle replacement

- Defensive driving

- Vehicle safety

- Accident forgiveness

- Roadside assistance

- Multi-car

- Safe driving

- Lifetime repair guarantee

- Overseas coverage

Ways to Save on Auto Insurance: How Much Is Auto Insurance In Massachusetts

Auto insurance premiums can vary significantly depending on your individual circumstances and driving habits. By taking proactive steps to reduce your risk profile and take advantage of discounts, you can potentially save money on your auto insurance premiums.

Maintain a Clean Driving Record

One of the most important factors that insurance companies consider when setting your rates is your driving record. Maintaining a clean driving record by avoiding accidents, traffic violations, and DUIs can significantly reduce your premiums.

Choose a Higher Deductible

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premiums, as it reduces the insurance company's risk. However, it's important to choose a deductible that you can afford to pay if you need to make a claim.

Take Advantage of Discounts

Many insurance companies offer discounts for various factors, such as:

- Safe driver discounts for maintaining a clean driving record

- Multi-car discounts for insuring multiple vehicles with the same company

- Good student discounts for students with good grades

- Anti-theft discounts for installing anti-theft devices in your vehicle

State Regulations and Laws

Massachusetts has established specific regulations and laws governing auto insurance, ensuring that drivers are adequately protected and responsible on the road. These regulations include minimum coverage requirements and penalties for uninsured driving.

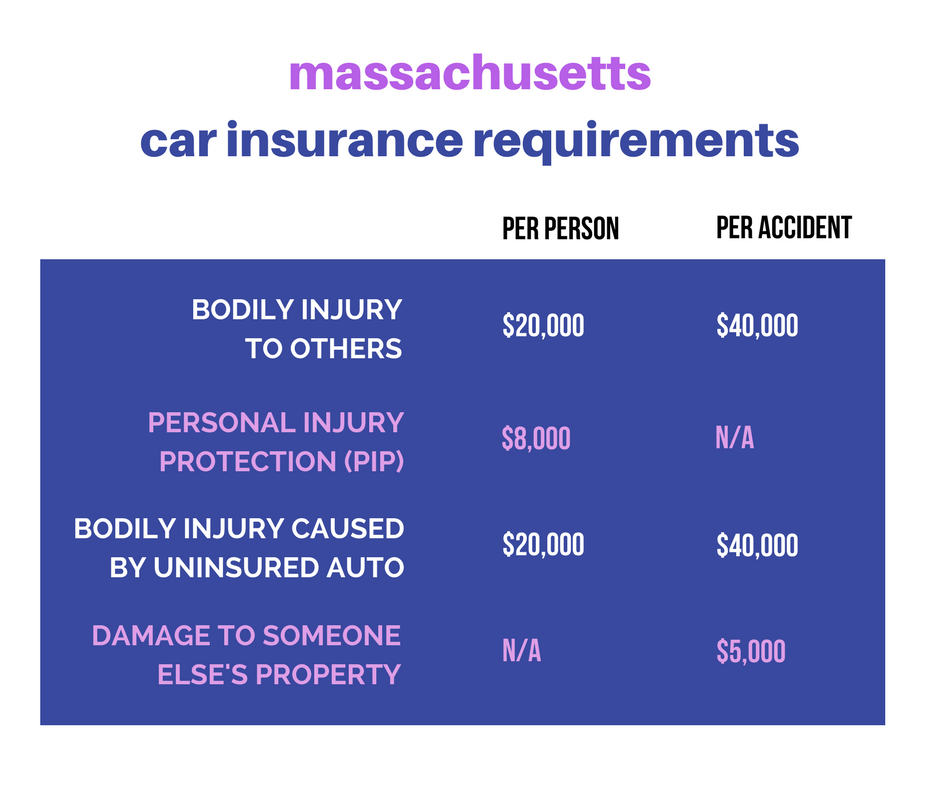

Minimum Coverage Requirements, How much is auto insurance in massachusetts

Massachusetts law mandates that all drivers carry a minimum level of auto insurance coverage, including:

Bodily injury liability coverage

$20,000 per person and $40,000 per accident

Property damage liability coverage

$5,000 per accident

Uninsured motorist bodily injury coverage

$20,000 per person and $40,000 per accident

Penalties for Uninsured Driving

Driving without insurance in Massachusetts is a serious offense, and violators face significant penalties, including:

- Fines ranging from $500 to $5,000

- License suspension for up to one year

- Vehicle impoundment

- Increased insurance premiums upon reinstatement of driving privileges

These regulations and laws aim to ensure that Massachusetts drivers are financially responsible for any damages or injuries they may cause while operating a vehicle. By adhering to these requirements, drivers can protect themselves, other motorists, and pedestrians on the road.

Additional Considerations

In addition to the aforementioned factors, other elements can influence auto insurance costs in Massachusetts.

Factors like garaging location, annual mileage, and the presence of additional drivers on the policy can affect premiums. It is crucial to provide accurate information about these aspects to ensure an accurate assessment of your insurance needs.

Garaging Location

The location where you park your vehicle overnight can impact your insurance rates. Areas with higher crime rates or frequent accidents may result in increased premiums.

Annual Mileage

The number of miles you drive annually can influence your insurance costs. Drivers who travel more miles are exposed to a higher risk of accidents, leading to potentially higher premiums.

Additional Drivers

If additional drivers are listed on your policy, their driving records and experience can affect your insurance rates. Inexperienced or high-risk drivers may increase your premiums.

End of Discussion

In conclusion, understanding the nuances of auto insurance in Massachusetts empowers drivers to make informed decisions, optimize coverage, and safeguard their financial well-being. By considering the factors discussed, comparing providers, and implementing cost-saving measures, individuals can secure the protection they need at a price that fits their budget.