Ohio Insurance Rates: A Comprehensive Guide to Saving Money on Premiums

Ohio insurance rates can vary significantly depending on a number of factors, including your driving record, age, location, and the type of insurance you need. In this guide, we'll provide an overview of the Ohio insurance market, discuss the factors that influence rates, and share tips on how you can save money on your premiums.

The Ohio insurance market is a competitive one, with a number of different companies offering a variety of insurance products. This competition can lead to lower rates for consumers, but it's important to compare quotes from different companies before you buy a policy.

Ohio Insurance Market Overview

The Ohio insurance market is the seventh-largest in the United States, with a total market size of over $30 billion. The market has grown steadily in recent years, with an average annual growth rate of 3%. The key players in the Ohio insurance market include Nationwide, Progressive, and State Farm.

The regulatory environment in Ohio is relatively favorable for insurance companies. The state has a competitive insurance rating system, which allows insurers to compete on price. The state also has a strong consumer protection framework, which ensures that consumers are treated fairly by insurance companies.

Impact of Regulatory Environment on Insurance Rates

The regulatory environment in Ohio has a significant impact on insurance rates. The state's competitive insurance rating system allows insurers to compete on price, which has helped to keep rates low. The state's strong consumer protection framework also ensures that consumers are treated fairly by insurance companies, which has helped to prevent excessive rate increases.

Factors Influencing Ohio Insurance Rates

Insurance rates in Ohio are determined by various factors, each contributing to the overall premium calculation. Understanding these factors is crucial for policyholders to make informed decisions about their insurance coverage.

Claims History

Your claims history significantly impacts your insurance rates. Insurers consider the number and severity of accidents or claims you have filed in the past. A clean claims history generally leads to lower premiums, while frequent or costly claims can result in higher rates.

Driving Record

Your driving record is another key factor that influences insurance rates. Traffic violations, such as speeding tickets or accidents, indicate a higher risk to insurers. A clean driving record, on the other hand, can qualify you for discounts or lower premiums.

Age

Age is also a factor in determining insurance rates. Younger drivers, particularly those under 25, are considered higher risk due to their lack of experience and higher accident rates. As you age and gain more driving experience, your insurance rates may gradually decrease.

Location, Ohio insurance rates

Your location within Ohio can also affect your insurance rates. Insurers consider factors such as crime rates, population density, and traffic congestion in different areas. Living in a high-risk area, such as a city with frequent accidents or thefts, may lead to higher premiums.

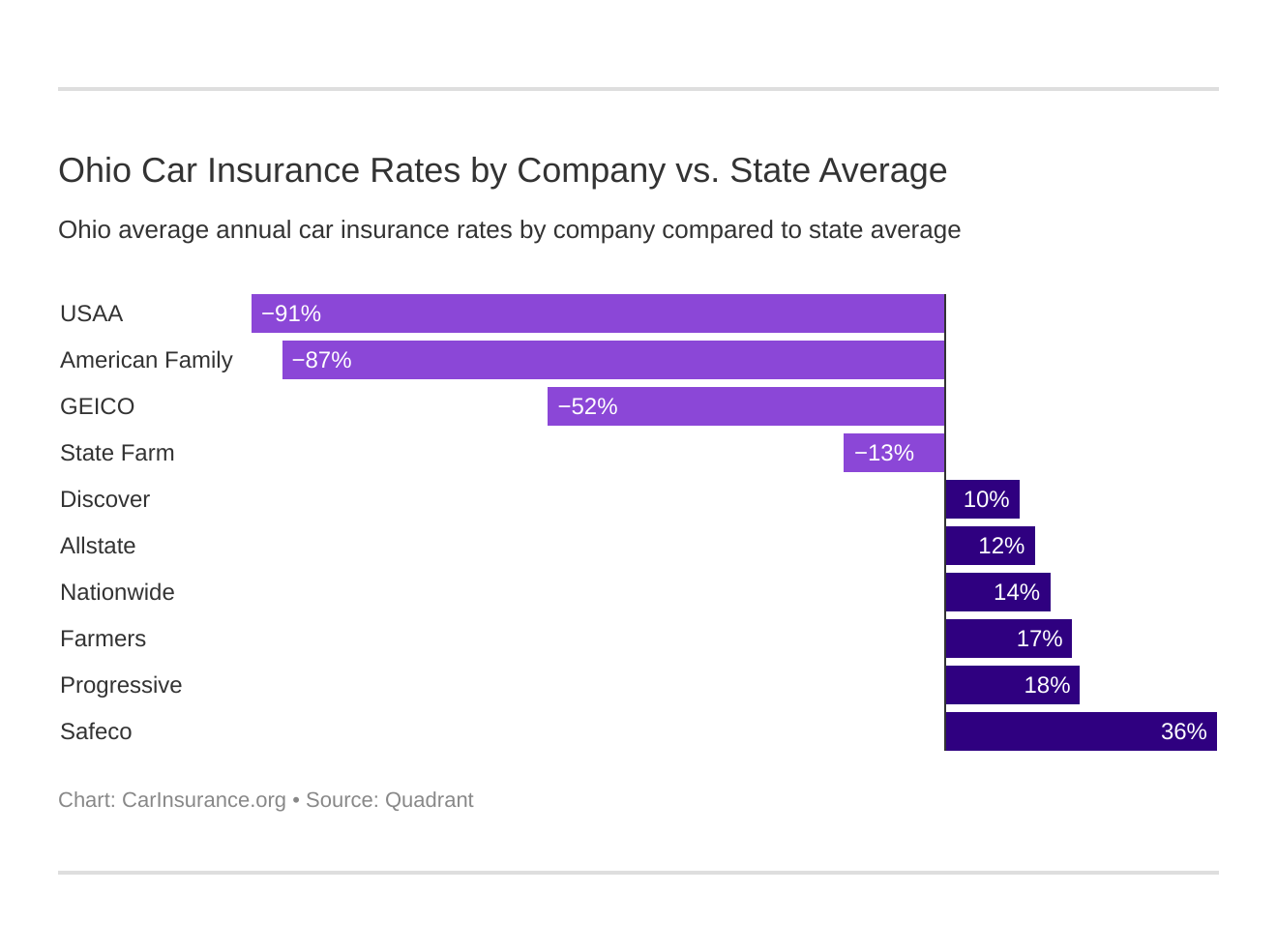

Comparing Ohio Insurance Rates

Insurance rates in Ohio vary significantly between different insurance companies. This variation can be attributed to several factors, including the company's financial stability, claims history, and underwriting guidelines.

To help consumers compare insurance rates, we have compiled a table of average rates for different types of insurance in Ohio.

Average Insurance Rates in Ohio

| Type of Insurance | Average Rate |

|---|---|

| Auto Insurance | $1,200 per year |

| Homeowners Insurance | $1,000 per year |

| Health Insurance | $5,000 per year |

As you can see from the table, there is a wide range of rates available for each type of insurance. This is why it is important to shop around and compare quotes from different companies before purchasing an insurance policy.

Factors Influencing Insurance Rates

There are a number of factors that can influence the insurance rates you pay, including:

- Your age

- Your driving record

- Your claims history

- Your credit score

- The type of insurance you are purchasing

- The amount of coverage you are purchasing

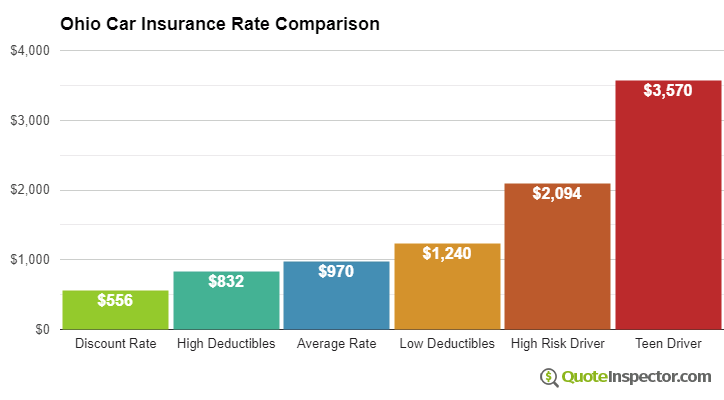

- The deductible you choose

By understanding the factors that influence insurance rates, you can make informed decisions about your insurance coverage and save money.

Ways to Save on Ohio Insurance

Ohio residents can take several steps to save money on their insurance premiums. Here are some tips and resources to consider:

Discounts and Programs

Many insurance companies offer discounts to Ohio residents, including:

- Multi-policy discounts: Bundling your home and auto insurance policies with the same company can save you money.

- Safe driver discounts: Maintaining a clean driving record can qualify you for discounts.

- Loyalty discounts: Staying with the same insurance company for a certain period can earn you discounts.

- Anti-theft devices: Installing anti-theft devices in your car can reduce your premiums.

- Good student discounts: Students with good grades may be eligible for discounts.

In addition to discounts, Ohio residents may also be eligible for the following programs:

- Ohio FAIR Plan: This program provides insurance to high-risk drivers who cannot obtain coverage from standard insurance companies.

- Ohio Senior Health Insurance Information Program (OSHIIP): This program provides free counseling and assistance to Ohio seniors with Medicare and other health insurance issues.

Shopping Around

It is essential to shop around for the best insurance rates in Ohio. Comparing quotes from multiple insurance companies can help you find the most affordable coverage. You can use an insurance agent or an online comparison tool to get quotes.When comparing quotes, consider the following factors:

- Coverage: Make sure that you are comparing policies with the same coverage limits and deductibles.

- Premiums: The premium is the amount you pay for your insurance policy.

- Deductibles: The deductible is the amount you pay out of pocket before your insurance coverage kicks in.

- Customer service: Consider the company's reputation for customer service.

By following these tips, Ohio residents can save money on their insurance premiums.

Closure: Ohio Insurance Rates

By following the tips in this guide, you can save money on your Ohio insurance premiums without sacrificing coverage. So what are you waiting for? Start comparing quotes today!